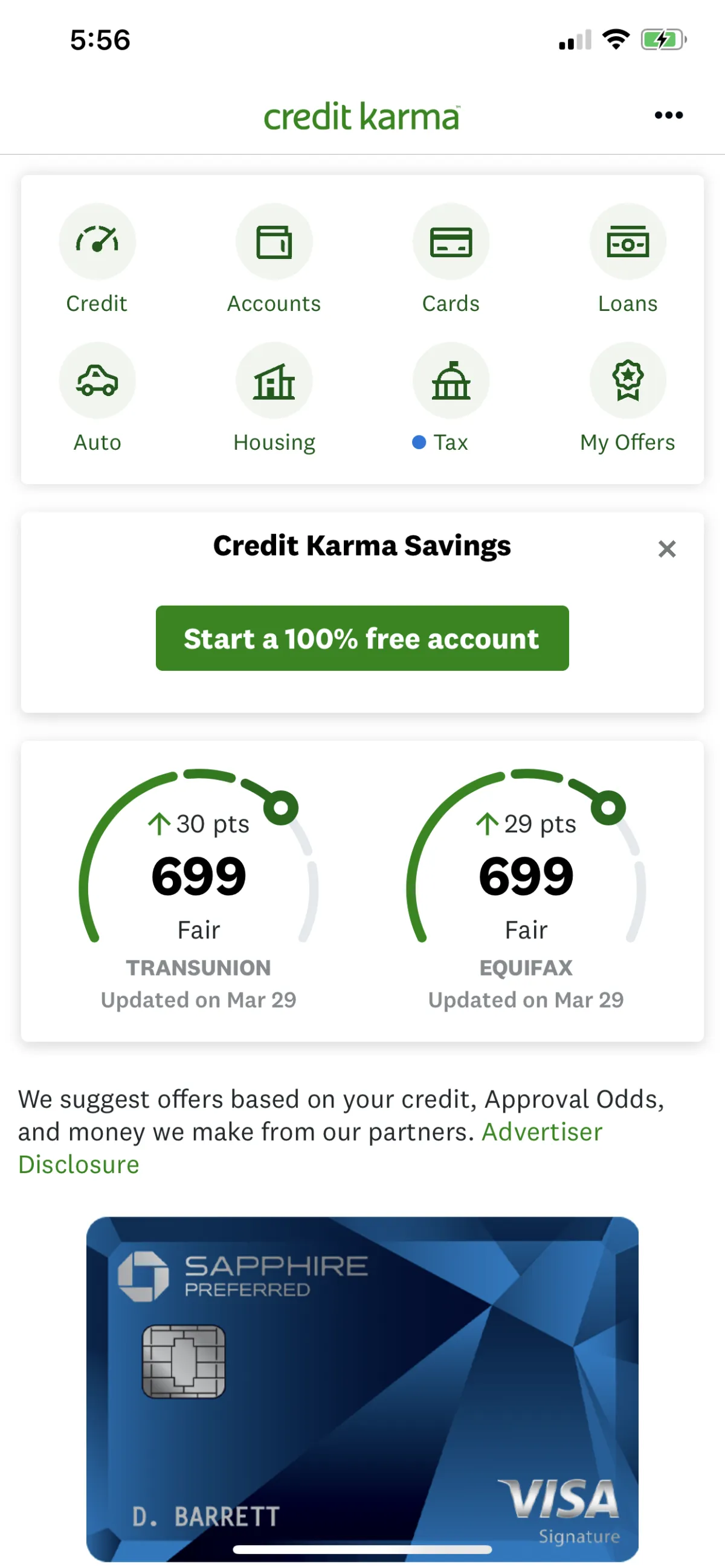

We Have The Most Aggressive & Quickest Credit Cleaning Strategy

To Bring Your Credit Score Back Up!

We Have A PROVEN Track Record of Generating Results In As Little As

30 - 45 Days! 😍

Why Choose The Credit Mechanics

In The World Of Consumer, Finding The Right Counseling Service Can Make All The Difference. At The Credit Mechanics, We Specialize In Delivering Top-Quality Solutions Designed To Meet Your Unique Needs. Whether You're Looking For Expert Support Or High-Quality Counseling Service, We Are Here To Help You Succeed.

Take Action Now! Empower Your Financial Future

Let The Credit Mechanics guide you toward a stronger credit score and a brighter tomorrow. Our expert team is here to support your journey every step of the way

Credit Report Analysis

Gain a clear understanding of your credit standing with our in-depth credit report analysis.

Dispute Resolution

We don’t wait on the credit bureaus — we go to work fast to challenge outdated, inaccurate, or unfair items hurting your score.

Debt Management

Our experts provide personalized advice to help you manage debt, and give you personalized plan to help you go debt free

We Have A PROVEN Track Record of

Generating Results In As Little As 30 - 45 Days!

Why Should You Choose Us?

It's Simple.

We Get Results!

Don't Believe Us?

APPLY BELOW TO SEE IF

YOU QUALIFY!

If You Are Approved,

You Will Become Apart of The TheCredit Mechanics Family & We Can Get Started on Boosting Your Credit Score!

Frequently Asked Questions

Question 1: How do you lorem ipsum?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Question 2: What do you lorem ipsum?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Question 3: When can I lorem ipsum when I buy?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Question 4: What if I feel stuck with lorem ipsum?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Our Team Of Experts Brings Years Of Experience, Ensuring That You Receive The Best Counseling Service To Enhance Your Success.